At the end of September 2025, the ordinary expenses of the State of Senegal amounted to 3,220.8 billion CFA francs, representing 72.7% of the credits provided for in the Amended Finance Law (LFR). This dynamic comes at a time when the budget deficit stood at 4.88% of GDP over the same period, a level below the annual target of 7.82%, but still well above the UEMOA convergence criterion (3%). Budget execution confirms the government’s commitment to initiate a gradual consolidation, in an environment marked by the absence of a new program with the IMF and the recent downgrade of the sovereign rating by S&P and Moody’s.

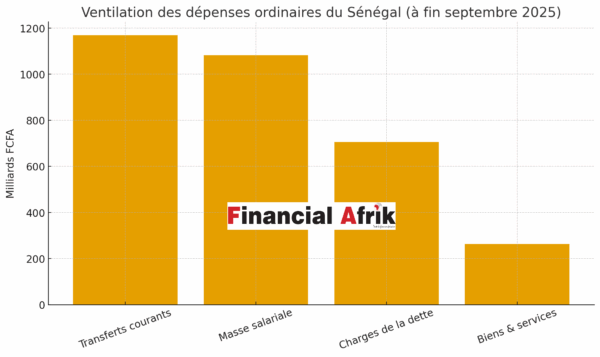

The structure of ordinary expenses highlights significant rigidities:

– The wage bill reached 1,082.8 billion CFA francs, representing 33.6% of ordinary expenses, an increase of 3.7% over the year. It remains one of the main areas of budgetary rigidity, in a context where the public workforce now exceeds 189,900 employees.

– Debt charges amount to 705.7 billion CFA francs, representing 21.9% of ordinary expenses, with nearly 78% directed towards external debt. This pressure comes as Senegal’s debt-to-GDP ratio remains in the high range of regional standards and is a point of contention in the political debate on the sustainability of the budget trajectory.

– Current transfers, largely driven by energy subsidies, amount to 1,169.4 billion CFA francs, representing 36.3% of ordinary expenses. The energy subsidy alone has increased by 51.4%, from 271.7 to 411.6 billion CFA francs, reflecting the impact of tariff compensation and the persistence of a costly budget support model.

Other items remain secondary: goods and services (262.8 billion), slightly up, reflect a relative control of public purchases despite operational tensions in education, security, and health.

Meanwhile, investment expenditures total 1,092.2 billion, representing 56.4% execution, mainly supported by external financing (734.4 billion), while investments from internal resources remain low (40.8 billion). The government anticipates a “catch-up effect” in the fourth quarter, the usual period for completing projects and disbursements.

On the revenue side, the State mobilized 3,254 billion CFA francs, representing 69.7% of annual targets, driven by a 7.6% increase in tax revenues. Direct taxes (IS, IRVM/IRCM, CFCE) show good performance, despite a constrained economic climate and a decrease in investor confidence due to uncertainty about the macroeconomic framework.

In summary, while Senegal currently shows a better-controlled deficit than anticipated, the main focus of the political debate now revolves around:

– The sustainability of debt,

– The combined weight of the wage bill and debt service (55.5% of ordinary expenses),

– The increasing level of transfers, especially towards energy,

– And the limited room for maneuver on internal investment expenditures.

A consolidation trajectory exists, but it remains fragile, dependent on the stabilization of the political climate, the return of a programmatic framework with financial partners, and a structural reform of rigid expenditures, now at the center of all economic discussions in the country.