Abidjan, September 18, 2025 – The PEPT Fund launches the second phase of the securitization operation called the Common Fund for Securitization of Electricity For All Claims (“FCTC EPT 2025-2040”) in the amount of 60 billion FCFA.

This new issuance follows the success of the first transaction, conducted from October 30 to November 20, 2023, in an amount equivalent to 60 billion FCFA.

This securitization operation allows the PEPT Fund to raise medium and long-term resources from investors in the regional financial market, enabling the acceleration of the program to connect the most disadvantaged households to the national electricity grid.

Indeed, since 2014, the Electricity for All Program (PEPT), an initiative under the Government’s Social Program within the framework of its vision “Côte d’Ivoire 2030”, aims to facilitate access to electricity for all populations living in electrified areas of Côte d’Ivoire.

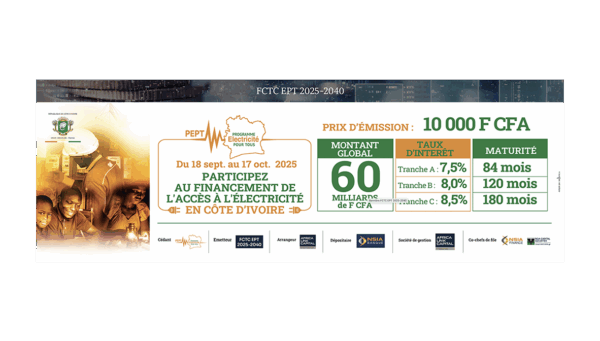

The current operation, called “FCTC EPT 2025-2040”, aims to raise an amount of 60 billion FCFA, divided into three maturity tranches of 7, 10, and 15 years, respectively remunerated at 7.50%, 8.0%, and 8.5%.

The securitization mechanism used in this transaction involves the transfer to a Common Fund for Securitization of Claims (FCTC) by the PEPT Fund of a portion of its existing or future claims held on connected households. The FCTC issues bonds that are offered to regional and international investors. Debt servicing is ensured by the recovery of the transferred claims throughout the life of the Fund.

The bonds are aligned with the ESG (environmental, social, and governance) principles, a alignment confirmed by the international rating agency Moody’s. The Transaction also benefits from a rating by the agency GCR Rating West Africa, “AA” for Tranche A, “AA-” for Tranche B, and “A+” for Tranche C.

According to the Minister of Mines, Petroleum, and Energy, Mr. Mamadou SANGAFOWA-COULIBALY, “the securitization of claims operation is a success on many levels: It allows the Government to continue implementing the Social Program (PS Gouv) without increasing the state’s debt and it promotes access to electricity for our fellow citizens, thus improving their living conditions. Finally, it is an opportunity for our populations to invest in a responsible and supportive manner.”

Mr. Zahalo SILUE, President of the Management Committee of the PEPT Fund, stated that the PEPT has connected more than 2.5 million households in its entirety by the end of July 2025. The securitization operation of the PEPT claims, with a total amount of 120 billion FCFA over the 2 phases, will finance the realization of 800,000 new connections over the period 2024-2027.

Finally, Mr. Olivier GUI, General Manager of ALC Securitization, the management company of the FCTC EPT, praised the renewed trust granted by the PEPT Fund for the launch of this second operation. According to him, “the structuring of this operation illustrates the ability to mobilize innovative and alternative financing solutions in the service of economic development and the improvement of living conditions for our populations.”

This operation is supported by international technical and financial partners, who have provided their expertise and intervene as reference investors.

The subscription period for the FCTC EPT 2025-2040 operation is open from September 18 to October 17, 2025. Orders can be placed with all approved Management and Intermediation Companies (SGI) of the UEMOA. The placement is coordinated by BOA Capital Securities and NSIA FINANCE, co-lead managers.

At the end of the subscription period, the operation will be listed on the BRVM.

The FCTC EPT 2025-2040 will be managed by ALC Securitization, marking its 13th operation on the regional financial market.

About the Electricity For All Program

Launched in October 2014, the Electricity For All Program (PEPT), launched in October 2014, is an initiative under the Government’s Social Program (“PS-GOUV”), and aims to facilitate access to electricity for all populations living in electrified areas of Côte d’Ivoire, by simplifying access procedures and facilitating payment methods for connection fees.

About ALC Securitization

Africa Link Capital Securitization (ALC Securitization) is the first independent private company managing Common Fund for Securitization of Claims (FCTC) in the West African Economic and Monetary Union (UEMOA), approved by the AMF-UMOA (Financial Markets Authority of the West African Monetary Union) in 2012.

The Securitization division of the ALC group, which includes two entities (ALC Structuration and ALC Securitization), has carried out nearly fifteen securitization operations in the energy, banking, and real estate sectors.

www.alc.ci