By Professor Abderrahmane Mebtoul, University Professor, International Expert, Doctor of State (1974) in Management, Chartered Accountant from the Higher Institute of Management in Lille, France.

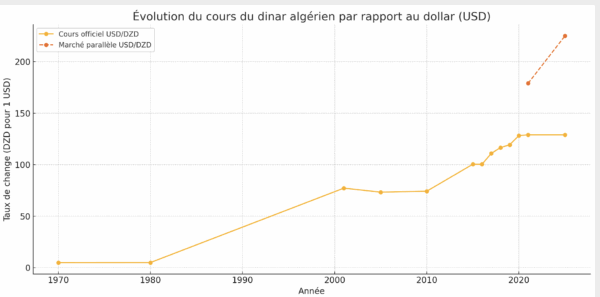

The official exchange rate of the dinar went from 4.94 dinars for 1 dollar in 1970 to 5.03 dinars in 1980. In 2001, it was 77.26 dinars for 1 dollar and 69.20 dinars for 1 euro. In 2005, the rates were 73.36 dinars for 1 dollar and 91.32 dinars for 1 euro; in 2010, 74.31 dinars for 1 dollar and 103.49 dinars for 1 euro; in 2015, 100.46 dinars for 1 dollar and 111.44 dinars for 1 euro; in 2016, the same rates were observed; in 2017, they were 110.96 dinars for 1 dollar and 125.31 dinars for 1 euro; in 2018, 116.62 dinars for 1 dollar and 137.69 dinars for 1 euro; in 2019, 119.36 dinars for 1 dollar and 133.71 dinars for 1 euro; in 2020, 128.31 dinars for 1 dollar and 161.85 dinars for 1 euro.

Before the agreements with the IMF in 1993, the exchange rate was administrative, making comparisons with the current period less significant. Adjustments to the market began around 1993-1994. The gap between the official rate and the parallel market rate ranged between 30 to 35% around 1995 and between 40 to 50% in the 2000s. In 2021, on May 18, the dollar was exchanged at 179 dinars and the euro at 210 dinars in the parallel market.

By the end of June 2025, the euro crossed the symbolic threshold of 260 dinars in the informal market: 259 dinars for buying and 263 dinars for selling compared to an official rate of 152 dinars, representing a gap of 73.30%. The dollar was exchanged at 225 dinars for buying and 229 dinars for selling compared to an official rate of 129 dinars, representing a gap of 77.51%.

Regarding the informal sector, cash circulation outside banks increased by 12.93%, from 5,437.6 billion dinars at the end of 2019 to 6,140.7 billion at the end of 2020, representing 34.73% of the M2 money supply. In 2022, it was 33.35% compared to 33.47% in 2021. In 2023, cash circulation reached 8,300.76 billion dinars, equivalent to 59.49 billion dollars at a rate of 135 dinars for 1 dollar. In 2024, it still accounted for over a third of the money supply.

- Main reasons for the gap between the official rate and the parallel market

- Low productivity, project overpricing, and dependence on hydrocarbons.

- Decrease in remittances from residents abroad and informal practices.

- Increasing budget deficits and artificial inflation suppression.

- Demand for foreign currency for vehicle imports and travel.

- Low foreign exchange allocation (100 to 750 euros/year/person) encouraging black market transactions.

- Informal trade and opacity of unregulated imports.

- Travel agencies and operators in tourist services in the black market.

- Investment in real assets (real estate, gold, currencies) to hedge against inflation.

- Distrust of economic policy and anticipation of devaluation.

- What solutions?

- Recognize that the informal sector is a response to the weakness of the job market.

- Create formal jobs in high value-added sectors.

- Improve education and combat inequality.

- Tax relief to broaden the tax base and reduce fraud.

- Reform regulatory framework and economic governance.

- Improve public services (security, financing, property).

- Exchange rate stability through coherent economic policies.

- Formalize property ownership and retail trade.

- Customs tax reform and logistics chain reform.

In conclusion, any sustainable strategy must take into account the sociocultural reality and restore trust, without which no sustainable development is possible.