The mining week ending December 28, 2025 is marked by an end-of-year atmosphere heavy with questions. The traditional holiday truce did not calm the markets: it rather crystallized doubts about inflation, the trajectory of interest rates, and geopolitical vulnerabilities. In this climate, gold once again emerges as the ultimate safe haven asset, while industrial metals evolve more heterogeneously, depending on the economic situation and stocks.

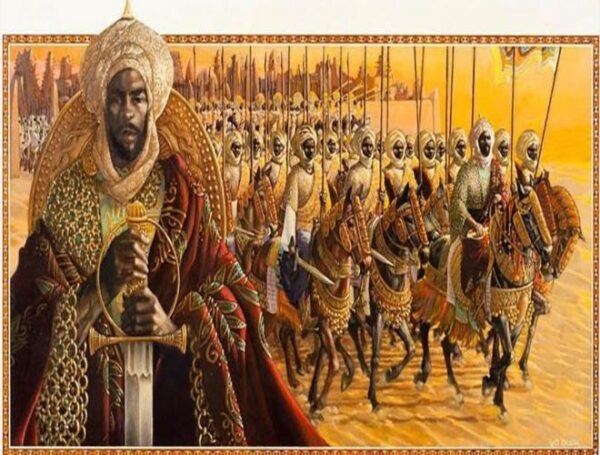

Over the week, the yellow metal appreciated by 3.7%, reaching a record of $4,546.37 per ounce (1 ounce = 31.1 g). “When investors fear inflation, crises, or future lower interest rates, gold naturally becomes a store of value,” summarizes a financial analyst based in Marrakech. Symbolic heir of the “metal of Kankan Moussa,” gold thus maintains its dominant status in times of monetary uncertainty.

In contrast, industrial metals – copper, zinc, or aluminum – remain more correlated to real economic activity, investment dynamics, and stock levels. Iron ore appears almost stable, while lithium shows a rebound after a phase of strong volatility typical of metals linked to the energy transition.