The tragi-comic coup d’état that shook Bissau in November 2025 plunged the international community into a mix of astonishment and hesitation. It’s hard not to see an almost absurd scenario: a deposed president freely giving interviews about his own downfall. We are far from the dramatic closed-door situation in the case of Bazoum in Niger in July 2023. But behind the theater, the repetition of the scenario is intriguing. Umaro Sissoco Embaló is no stranger to this kind of episode. In February 2022, an attempted coup d’état – never fully established – offered him the perfect opportunity to neutralize his opponents and reshape the Parliament.

This time, in 2025, the coup occurred just as Fernando Dias, an independent candidate, was clearly leading according to ongoing compilations. A coincidence? Really? Without Commandante Embaló’s nighttime landing in Senegal on November 27, 2025, the hypothesis of a setup would have been widely accepted. One certainty remains: once again, the people of Guinea-Bissau are deprived of their victory with dramatic consequences for their faltering economy and their weekly borrowings on the West African Economic and Monetary Union (UEMOA) money market.

And this is where ECOWAS comes into the picture – or out of it. This coup represents a frontal attack on its founding principles. How long will the organization tolerate the trampling of popular will? Since the Malian (2020-2021), Burkinabe (2022), and Nigerien (2023) crises, its mechanism for democratic defense seems completely outdated. The Standby Force is… standing by. The democracy protocol remains a dead letter.

Tolerating Bissau’s institutional adventure sends a clear message: all democracies in the region could falter tomorrow.

It is time to recall a simple but essential truth: the place of armies is in the barracks – and at the borders to protect our nations from terrorism – not in presidential palaces.

History will judge. But for now, it is ECOWAS that is playing for its credibility.

Enclosure

Bissau Heading Towards Record Risk Premiums

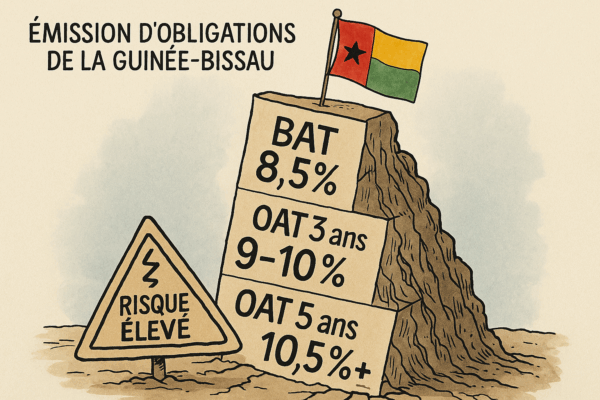

This rupture comes at a time when Guinea-Bissau was among the most active issuers in the UMOA Securities market since the beginning of the year, frequently resorting to BAT and OAT to cover its structural deficit. Investors had already noted warning signs:

– BAT 364 days above 8.5%,

– OAT 3 years around 9-10%,

– OAT 5 years nearing or exceeding 10.5%, making it one of the highest risk premiums in the area, far behind benchmark signatures like Côte d’Ivoire or Senegal.

The November coup now acts as a risk catalyst: analysts anticipate potential rates above 11% if the Guinea-Bissau Treasury returns to the market soon. Future auctions could underperform, and international investors, already cautious, are reassessing regional risk. In a UEMOA seeking depth, liquidity, and attractiveness, this crisis arrives at the worst possible moment.

Behind the scenes, a common observation among specialists is that accountants will say, coups d’état are not a rational income statement. Politics creates entropy, and markets immediately punish it. ECOWAS and UEMOA, already tested by the Malian, Burkinabe, and Nigerien crises, see their credibility put to the test. Tolerating this precedent in Bissau would send a signal of instability to the entire area.

The events in Bissau will be scrutinized hour by hour, but one certainty already stands out: political volatility has a cost, and the market is starting to quantify it.