By Professor Amath Ndiaye, FASEG UCAD

The aim is to analyze the trade balance of ECOWAS countries and to show that external imbalances are more the result of the outward-oriented structure of economies than of fixed or flexible exchange rates.

Contrasting trade balances

Examination of average data for the period 2013-2023 highlights significant differences between UEMOA and ZMOA countries (source: WDI).

- UEMOA countries (fixed exchange rate, FCFA): trade deficits average around -10.9% of GDP. However, there are significant internal disparities: Ivory Coast achieves balance (0%), while Senegal (-22%), Niger (-14%), and Mali (-13%) show significant deficits.

- ZMOA countries (floating or flexible exchange rate): deficits are deeper, with an average of -15.7% of GDP. Liberia (-28%), Gambia (-25%), and Guinea (-23%) stand out for their particularly heavy imbalances, while Nigeria limits its deficit to only -2%, thanks to its oil exports.

- Special case: Cabo Verde, despite being on a fixed regime, also shows a high deficit (-17%), confirming that the exchange rate regime alone is not sufficient to explain performance.

Exchange rate regime and trade performance

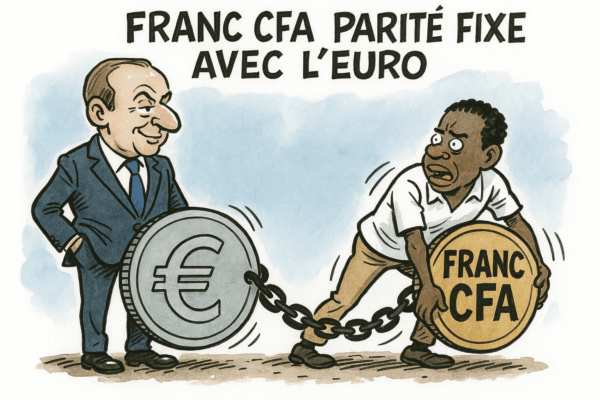

The figures clearly show that countries with a fixed exchange rate (UEMOA) on average have less pronounced deficits than those with a floating exchange rate (ZMOA). The exchange rate pegged to the euro has helped stabilize prices, contain inflation, and maintain some macroeconomic discipline, reflected in less severe imbalances.

The example of Ivory Coast is particularly revealing: despite a fixed exchange rate regime, this country achieves a balanced trade, proving that monetary stability is not an obstacle to competitiveness when the productive apparatus is diversified and oriented towards exports.

Conversely, some ZMOA countries, with a floating regime, experience frequent devaluations which, far from durably correcting deficits, worsen them by increasing import costs and reducing trade stability.

The real cause: the outward-oriented structure of economies

If the exchange rate regime plays a role, it is not the determining factor. External imbalances in West Africa are primarily structural, linked to the outward-oriented nature of economies:

- Primary specialization: cocoa, cotton, peanuts, gold, oil, bauxite. These raw products, subject to fluctuations in global prices, dominate exports.

- Massive dependence on imports: food products, hydrocarbons, manufactured goods, and industrial inputs absorb an increasing share of foreign exchange.

- Low regional integration: intra-ECOWAS trade remains below 15%, limiting the ability of regional trade to cushion external shocks.

- Importer growth model: consumption and public investment rely heavily on imported equipment and products.

Ultimately, the structural trade deficit does not mainly come from the exchange rate regime, but from low productive diversification and lack of local transformation.

Conclusion

A comparative analysis between UEMOA and ZMOA shows that:

- Countries with fixed exchange rates (UEMOA) have shallower deficits on average (-10.9%) than those with floating exchange rates (-15.7%).

- Ivory Coast illustrates that a competitive CFA country can balance its trade despite a fixed exchange rate.

- Nigeria, thanks to its hydrocarbons, limits its deficits, but its floating regime has not durably stabilized its currency or external balances.

- West African external imbalances are primarily the result of the outward-oriented structure of economies, rather than the choice of exchange rate regime.

The real challenge for the future is to diversify production, locally transform resources, and strengthen intra-African trade to reduce external dependence and durably improve trade balances.

About Professor Amath Ndiaye

Prof. Amath Ndiaye is a prominent Senegalese economist, holding a Doctorate in Economics from Cheikh Anta Diop University in Dakar (2001) and a 3rd cycle Doctorate in Development Economics from the University of Grenoble, France (1987). Since 1987, he has been teaching at the Faculty of Economics and Management Sciences at Cheikh Anta Diop University in Dakar. A recognized expert, he has collaborated with prestigious institutions such as the African Development Bank, the World Bank, and the IMF, specializing in exchange rates, economic growth, and institutional development. He was an expert member of the steering committee of the African Union Commission for the Creation of the African Central Bank. Prof. Ndiaye is the author of numerous influential publications, particularly on exchange rate regimes and economic growth in West Africa. Fluent in Wolof, French, and English.