The Ghanaian government announced on Monday, August 4, 2025, a spectacular increase in the cocoa production price. Local producers will now receive $5,040 per ton, or approximately €4,353. This represents a 62.58% increase compared to the previous campaign, where the price was set at $3,100. This decision, which increases the share of the FOB price (export price) paid to farmers to nearly 70%, marks a clear break in the support policy for cocoa growers and gives Ghana a decisive social and political advantage in the discreet war between the world’s top two cocoa producers.

Meanwhile, in Côte d’Ivoire, the price paid to producers remains fixed at 1,500 CFA francs per kilo, or approximately $2,440 per ton. At this level, Ivorian farmers receive less than half of what their Ghanaian neighbors now receive. The contrast is striking and calls for explanations: two countries, the same product, identical international markets, but two diametrically opposed approaches to the redistribution of cocoa rent.

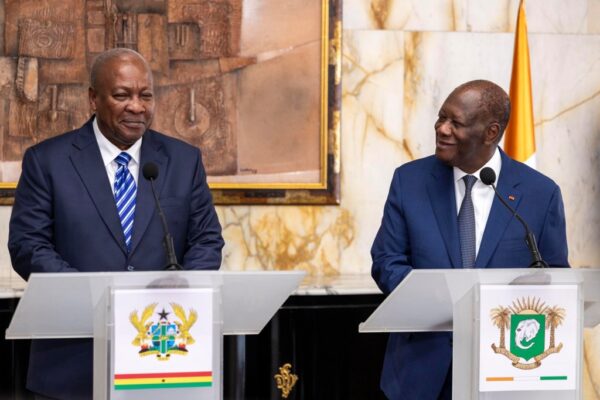

In Accra, this increase comes in an electoral context. President John Mahama, who returned to power with a focus on social justice and rural development, is fulfilling a campaign promise. The signal is political, but also economic: better remunerate farmers, strengthen agricultural sovereignty, and limit illicit sales to neighboring countries. By pushing the share of the FOB price redistributed to 70%, compared to 63.9% a year earlier, Ghana is pursuing a proactive and risky policy, betting on a sustainable increase in global prices and on rigorous management of COCOBOD, the sector’s regulatory body.

In Abidjan, caution is the order of the day. The system of forward sales locks in price increases and gives the state a slower adjustment margin. Côte d’Ivoire, which represents nearly 45% of the global market, continues to prioritize macroeconomic stability, even at the expense of agricultural income. This decision is causing growing discomfort among farmers, especially as cocoa prices have reached record levels in recent months. The Ivorian FOB price is now around $4,000 per ton, without this windfall fully translating into the pockets of producers.

The consequences will not be long in coming. The wage gap risks fueling cross-border smuggling, with Ivorian cocoa flowing to Ghana, where prices are twice as attractive. It also reinforces the image of a socially daring Ghana compared to a managerial but inflexible Côte d’Ivoire. Beyond bilateral rivalry, this divergence casts a shadow over the Ivory Coast-Ghana Cocoa Initiative, a common mechanism for coordinating cocoa policies, now being tested by national realities.

Clarity is therefore needed. The international market is closely watching this new asymmetry between the two African cocoa giants. In this battle for fair prices, Ghana has taken the lead. It remains to be seen if Abidjan can maintain its course without reevaluating the position of the farmer in the value chain.

It is worth noting that the price of cocoa has dropped from a historic peak of $12,931 in December 2024 to around $8,100 in early August 2025, a decrease of nearly 40%. This correction reflects a gradual easing of tensions on the overall supply: production resumption, stocks replenished, and a withdrawal of excessive speculation. However, despite this sharp drop, prices remain historically high, and the season is still marked by a risk of significant short-term fluctuations.