Dakar, June 30, 2025 – Fintech Wave Mobile Money, one of the leaders in mobile money in Africa, announced a fundraising of 117 million euros through a loan led by Rand Merchant Bank (RMB). This strategic operation, supported by a consortium of international development financial institutions – including British International Investment (BII), Finnfund, and Norfund – aims to strengthen Wave’s expansion in its key markets and to extend access to digital financial services to millions of underbanked people.

Already active in eight countries, mainly in West Africa, Wave aims to consolidate its presence in markets such as Senegal, Ivory Coast, and Mali, while opening up to new territories with high potential.

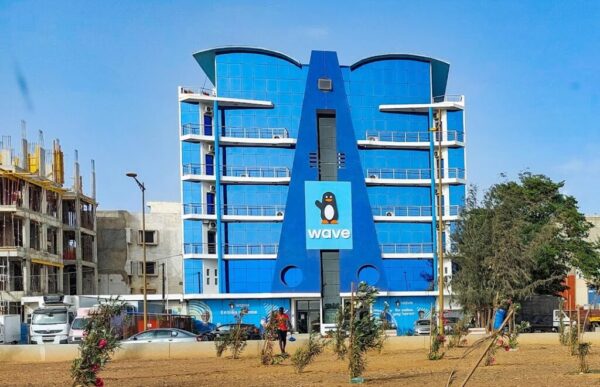

Since its creation in 2018, the company has attracted over 20 million active monthly users, thanks to a mobile-first model based on low fees, a simple interface, and 24/7 customer service. With a network of over 150,000 agents and 3,000 employees across the continent, Wave is a leading player in financial inclusion.

“This financing marks a key milestone for Wave and the future of mobile money in Africa,” says Coura Sène, Regional Director at Wave. “It reflects a growing confidence in our ability to transform access to financial services for historically marginalized populations.”

For Drew Durbin, CEO and co-founder of Wave, “this financial support will allow us to continue our mission of making financial services as accessible and affordable as possible.”

A structured financing with a strong social impact

As the lead of the fundraising, Rand Merchant Bank highlights the transformative nature of the operation. “We are proud to support Wave in this new phase of its development. This structured fundraising will expand financial inclusion in strategic markets,” comments Sibusiso Tashe, Co-head of Leveraged Finance at RMB.

Chris Chijiutomi, Director of Africa at British International Investment, emphasizes the essential role of Wave in reducing transaction costs and streamlining payments in fast-growing economies. “Wave’s impact now extends to Burkina Faso, Gambia, Mali, and Niger, with a simple and scalable solution.”

Norfund and Finnfund, already shareholders since 2022, confirm their commitment to this new phase. Marianne Halvorsen (Norfund) points out that Wave often represents the first contact with financial services for its users. Tuomas Vaulanen (Finnfund) also praises a measurable impact: 80% of users report a direct improvement in their quality of life.

Towards a more inclusive digital finance ecosystem

Wave’s success relies on strong collaboration with local authorities, central banks, and institutional partners. The company aims to build a secure, sustainable, and accessible mobile money ecosystem that can enhance economic autonomy, especially for women and micro-entrepreneurs.

With this 117 million euros financing led by Rand Merchant Bank, Wave confirms its position as a catalyst for financial inclusion in Africa and intends to continue its mission of large-scale transformation.