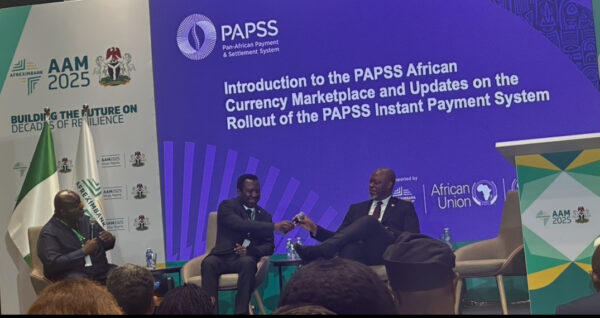

Abuja, June 25, 2025 – The Pan-African Payment and Settlement System (PAPSS), a flagship initiative of Afreximbank in partnership with the African Union Commission and the AfCFTA Secretariat, has reached a major milestone with the official launch of the African Currency Marketplace, a groundbreaking platform designed to streamline cross-border payments in local currencies across Africa.

Named the African Currency Marketplace, this new feature aims to eliminate dependence on strong currencies (such as the dollar or euro) in commercial exchanges between African countries. The principle: allow a transaction to initiate in a local currency and conclude in another, without intermediate conversion into a foreign currency. “No hard currency involved,” summarized Mike Ogbalu, CEO of PAPSS, on the sidelines of the official opening of the 2025 Afreximbank Annual Meetings in Abuja.

The system operates in real-time, 24/7, with transactions finalized within minutes, relying on an integrated network of 16 central banks, over 150 commercial banks, and 14 national switches.

This launch comes at a time when large African companies – airlines, industrial groups, insurers, or telecom operators – are facing persistent obstacles. For example, as Mike Ogbalu recalls, over $2 billion is currently “trapped” in African countries where airlines operate, unable to repatriate their funds due to exchange restrictions or depreciation of local currencies.

Faced with this situation, African multinationals are actively seeking solutions to operate effectively across the continent. This is the issue that the Currency Marketplace aims to address: reduce payment frictions, secure operations, and strengthen the monetary sovereignty of African states.

In this development, PAPSS relies on Interstellar, the first pan-African blockchain infrastructure provider, founded by Ernest Mbenkum. Interstellar brings cutting-edge technology via the Bantu network, a unique African blockchain designed to support a complete KYC system and manage up to 43 African currencies.

This alliance between Web3 technology and continental financial institution marks a first in the history of cross-border settlement systems in Africa.

Initiated in 2019 at the extraordinary African Union summit in Niamey, PAPSS was officially launched in January 2022 in Accra. This system is part of the strategic implementation of the African Continental Free Trade Area (AfCFTA), as an essential tool for financial integration.

Since its launch in the West African monetary zone, PAPSS has expanded its network to 16 countries, gradually covering the entire continent.

With exponential growth in e-commerce, the African Currency Marketplace arrives at a pivotal moment. It is not about competing with existing players, but collaborating with banks, fintechs, and regulators to build a truly integrated African monetary market.

Through this initiative, Afreximbank, the African Union Commission, and the AfCFTA Secretariat reaffirm their commitment to building an economically united Africa, sovereign in terms of currency, and fully integrated on the financial front.