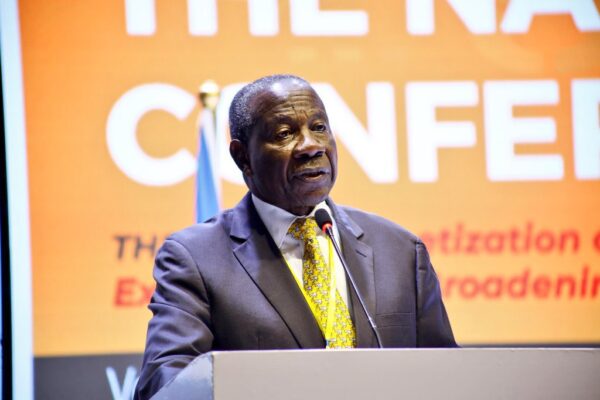

The Ugandan government aims to collect $10.33 billion in taxes during the financial year starting in July, Finance Minister Matia Kasaija said. The finance minister explained that the $20.07 billion budget will be primarily funded by Ugandans through taxes.

“The government plans to collect $10.33 billion (37,200 billion UGX) in domestic revenue for the 2025-2026 fiscal year. This will finance about 60% of the national budget. The rest of the budget will be financed through borrowing and grants,” said the minister, speaking about the budget on June 12, 2025, in front of parliament.

This will be achieved, he specified, by expanding the tax base, fighting corruption within the tax authority (URA), and combating smuggling at border points, among other measures.

In order to increase revenue collection, the government has proposed $10.43 billion to be collected at the national level, including $9.42 billion in tax revenue, $910 million in non-tax revenue, and $91.2 million in local government revenue. In addition, there are projections for domestic borrowing ($3.16 billion), domestic debt refinancing ($2.78 billion), subsidies and foreign borrowing ($577 million), among others.

“The financing strategy for the next financial year involves introducing new tax measures to increase domestic revenue by $149.4 million (538.6 billion UGX),” Minister Matia Kasaija said.

Uganda’s 2025/26 budget has introduced several tax reforms aimed at expanding revenue base and encouraging investment. One highlight is a 3-year tax exemption for startups with capital below $500 million.

The government has also increased excise duties on fuel and tobacco, while introducing VAT on certain agricultural inputs and in-kind social benefits. The reforms also include stricter compliance measures, including the use of national identity cards as tax identifiers.